Estate Preservation Through Charitable Giving

Kusum Sen, BA, CHS, Financial Advisor’s article on Estate preservation – Desjardins Financial Security Independent Network (DFSIN)

Ryan Daniels, Regional Sales Director, Desjardins Insurance1,

Good estate planning goes far beyond deciding who gets what; it speaks to the passion for giving and sharing. Whether your passion is to provide for those in need, create a scholarship, or even preserve Canada’s natural habitat, it can define your life and legacy. One can measure success beyond material possessions by making a difference.

People work hard to accumulate wealth throughout their lifetime, but upon death, up to half of it may be lost to taxation in Canada. Providing more of your estate to your beneficiaries is possible through a Canadian estate preservation strategy that employs life insurance and investments. The objective is to offset your final tax liability, depending on the province you reside in. The strategy is based on the idea of giving your heirs more of your estate.

Many of us want to leave a legacy by donating significantly to charity. As the baby boom generation moves into retirement, certain estate preservation strategies focus on minimizing a final tax bill and creating a lasting legacy through significant donations.

Why do people give to charity?

A StatsCan 2016 study provides some answers – compassion, a true belief in helping others, and the contribution made to one’s community were the leading reasons. Being personally affected by an organization’s cause and/or religious beliefs round out the top five reasons. The sixth reason for donating to charity was for the income tax credit. Many people are taking advantage of being charitable.

Donating life insurance proceeds to charity can offer immediate or deferred tax benefits in Canada, in addition to creating a valuable future gift for the organization. In such cases, the charity will receive the death benefit from the policy upon the death of the insured. In Canada, there are two options available for obtaining tax relief when donating life insurance. Donors have the chance to receive immediate or deferred tax relief, which can benefit their estate after death. During their lifetime, they can receive tax receipts for any donations or premiums paid towards a charity-owned life insurance policy. This allows for tax savings and potentially greater charitable contributions.

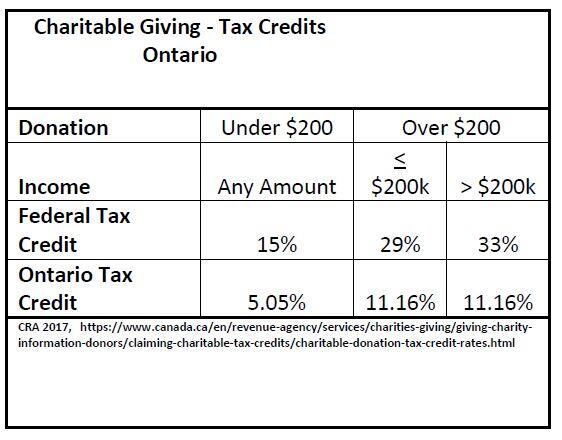

This credit is regulated both federally and provincially. The tax credit depends on the amount donated and the income of the individual donating. The following chart explains how donation credits are calculated in Ontario. The provincial rates vary across Canada.

Donating the Gift of Life Insurance by Estate preservation

Life insurance proceeds donated to an Ontario charity offer immediate or deferred tax benefits. The donation also creates a powerful future gift for the charity. The policy owner is insured, and the charity is the beneficiary. During premium payments, no donation receipts are given. However, upon the insured’s death, the charity receives the death benefit, and the insured’s estate receives a donation credit for the full benefit amount.

By providing an option to preserve your estate with planned giving, you can accomplish several goals. With Ontario’s traditional estate preservation methods, you can use life insurance to offset the tax liability to your estate by matching the amount to the expected tax bill.

For example, a couple in Toronto could purchase a policy that would pay out to the estate the expected tax liability on all of their assets upon the last of their deaths. In this scenario, the heirs benefit by receiving, in effect, the full value of the estate in Ontario – know-how.

It’s not what you take with you; it’s what you leave behind.

The Michael J. Fox Foundation is a leader in donations for Parkinson’s research. Today’s donations can lead to funding tomorrow’s treatments. Medical research in this field has improved the quality of life of those afflicted.

Giving & Saving with Graduated Rate Estates

The tax credit received by the estate can be used for the year prior to death, the year of death, or any of the following five years thereafter – A combination of these three may also be used. This provides great planning opportunities, especially for larger estates in Canada that may take years to wind down. Structuring when to claim the various donations matters because it will be a critical factor in determining the amount of tax you pay today, upon death, and what your heirs will need to pay after you are gone.

Through a charitable donation estate preservation strategy, you can make a substantial contribution to a cause you believe in, fulfilling your last wishes while supporting tomorrow’s treatments or cures. This act of goodwill not only creates a legacy but also helps reduce your final tax bill, ensuring that the full value of your lifetime’s assets is preserved. By choosing this approach, you can ensure that your philanthropic goals are met while securing the financial future of those you care about.

Do not go where the path may lead, go instead where there is no path and leave a trail.

– Ralph Waldo Emerson

For further information, please contact Ms. Kusum Sen, Financial Advisor with Desjardins Financial Security Independent Network (DFSIN):

155 Rexdale Blvd., Suite 406

Etobicoke, ON M9W 5Z8

Phone: 416 695-1433 ext. 0

Cell: 416 606-6088

Fax: 416 695-1713

kusum.sen@dfsin.ca

www.kusumsen.ca

This article should not be construed as insurance or financial advice or as an offer or solicitation to buy any products or services mentioned herein. No one should act upon the examples/information without a thorough examination of the legal/tax situation with the appropriate professional advisors.

(1 Desjardins Insurance refers to Desjardins Financial Security Life Assurance Company, a provider of life and health insurance and retirement savings products.)