Become a Financial Advisor in Canada

This article walks you through how to become a financial advisor in Canada, step by step. You’ll learn why this path offers opportunity, what makes DFSIN Toronto West unique, how partnering with Desjardins strengthens your position, how DFSIN Toronto West supports your independence and growth, what training and compensation look like, real success stories (drawn from public DFSIN Toronto West content), and the actual steps to apply.

Key Takeaways:

- You can maintain independence while gaining network support, resources, and brand backing if you choose a solid platform like DFSIN.

- DFSIN Toronto West offers differentiated benefits, an open product shelf, tech systems, mentorship, a financial centre backing, and business development support.

- With the right licensing, training, and strategy, your advisory practice with DFSIN Toronto West can scale, generate strong ROI, and deliver long-term growth.

Why Become a Financial Advisor in Canada

Canada’s financial services sector is mature, diversified, and growing. An aging population, rising wealth, increased demand for retirement and estate planning, and regulatory changes all fuel clients’ need for professional advice. As more individuals seek trusted guidance, the window for new advisors to stake a claim remains open.

Income potential is compelling. Advisors in Canada typically earn via fees (assets under management), commissions on insurance or investment products, or hybrid models. With scale and client retention, one advisor can move from modest income to strong six-figure earnings. Your ROI depends on client acquisition costs, retention, and operational efficiency.

Becoming a financial advisor also gives you control and purpose. You take charge of your brand and business direction. You make a meaningful impact on clients’ lives via planning, risk mitigation, wealth accumulation, and legacy design. That sense of mission keeps many advisors passionate.

What Makes DFSIN Toronto West Different from Other Financial Networks

DFSIN Toronto West (Desjardins Financial Security Independent Network) stands out in Canada’s advisory ecosystem. You get both autonomy and support, with a national brand behind you and local independence in your practice. At DFSIN Toronto West, you maintain your independence with access to an open product shelf, while benefiting from a vertically integrated dealer and MGA network.

The network is designed for both emerging and established advisors. Whether you’re just starting or you already have a firm, DFSIN Toronto West gives you tools to elevate your business. Their messaging emphasizes that many established advisor firms choose to partner to scale, while emerging advisors get the ramp to build long-term success.

You’ll also find this list of distinct DFSIN Toronto West advantages helpful:

- Open Product Shelf: You have the flexibility to recommend products (investments, insurance) from various providers rather than being locked into a proprietary suite.

- Tech & Platform Support: You tap into advanced tools like Equisoft, DataPhile, Wealthserv, and Conquest for CRM, portfolio management, and execution.

- Business Marketing & Design Help: DFSIN’s marketing and graphic design specialists work with you to sharpen messaging, create client materials, and differentiate your brand.

- Seamless Onboarding & Transition Support: You get help with compliance, licensing, transition of clients, and even assistance in acquiring or selling a book of business.

- Financial Centre Backing: You are paired with a local financial centre that becomes your support hub, mentorship, collaboration, peer ideas, and centre-level services.

This combination gives you the best of both worlds: autonomy and infrastructure.

The Advantages of Partnering with Desjardins

Desjardins brings scale, stability, brand power, and trust to your advisory partnership. As one of Canada’s major co-operative financial groups, Desjardins adds credibility to your practice. On the DFSIN Toronto West site, you’ll find that independent advisors “operate under our banner … backed by the strength of Desjardins, the leading co-operative financial group in Canada.”

Through Desjardins, you benefit from deeper resources in risk, compliance, capital, and cross-functional teams. That helps you navigate regulatory environments more smoothly. Moreover, Desjardins’ size and reach allow you to access product deals, economies of scale, and trust signals that clients already know.

Here are specific perks from aligning with Desjardins:

- Brand Recognition & Trust: The Desjardins name opens doors, reassures prospects, and reduces friction in client acquisition.

- Access to Capital & Backing: You may tap into financing resources, support for firm acquisitions, and transitions.

- Shared Support Infrastructure: You leverage compliance, legal, actuarial, operations, risk, and administrative teams at Desjardins’ scale.

- Cross-Referral & Network Strength: You can network across Desjardins’ ecosystem, insurance, banking, and wealth arms to bring holistic solutions.

- Stability in Volatile Times: When markets shift or regulations tighten, Desjardins’ balance sheet and institutional depth buffer headwinds.

In short, your independence gains resilience, your brand gains trust, and your back office gains muscle via this alliance.

How DFSIN Toronto West Supports Your Independence and Growth

DFSIN Toronto West is structured to let you run your own advisory business, while supplying scaffolding to accelerate growth and reduce overhead burdens. The philosophy is clear: independence matters, but support lets independence thrive.

You are not a cog in a machine; you own your client book, pick your business model, set your strategy. At the same time, you tap into shared services that carry you further and faster than going solo.

Support comes through targeted programs:

- Mentorship & Coaching: You’re paired with seasoned advisors or field leadership to guide business decisions and scaling steps.

- Business Development Aid: You get help in marketing, branding, client lead funnels, digital presence, and branding materials.

- Tech Stack & Admin Services: You don’t reinvent the wheel; DFSIN Toronto West gives you CRM, portfolio tools, compliance tech, and reporting frameworks.

- Continuing Education & Tools: They host training, certifications, content, and workshops to sharpen your advisory capability.

- Transition & Succession Support: You find assistance when buying or selling books of business or integrating new clients.

With this structure, you stay independent, yet your growth trajectory is threaded with support, not blind trial.

Training, Mentorship, and Continuing Education Opportunities

DFSIN Toronto West understands that skills, competence, and credibility matter more than marketing hype. Their training programs weave together licensing preparation, business skills, compliance, and client relations. From day one, you have access to structured onboarding that brings you quickly up to speed on tools, compliance, product knowledge, processes, and lead funnels.

Mentorship is not an afterthought. DFSIN’s financial centres act as hubs where advisors pair up, share ideas, and get practical coaching. Advisors like Billy Kailla describe team culture and peer support as key differentiators. Over time, you gain exposure to advanced training, mastermind groups, national conferences, and peer-led growth forums.

Continuing education keeps you sharp. You’ll log required CE credits, attend periodic workshops, and get updates on new products, regulations, tax strategies, and planning techniques. That ensures you stay not only compliant but competitive and trusted.

Compensation and Career Path as a DFSIN Toronto West Advisor

Your compensation evolves with performance, scale, and client retention. Early on, you’ll often be rewarded on a commission or fee basis for new clients and product sales. As you mature, your revenue comes more from recurring fees, asset-based income, and cross-sales.

DFSIN Toronto West promotes a clear path: starting as a beginner or associate advisor, advancing to lead advisor, then potentially team leader or centre head. As your book grows, you gain leverage, delegate, and shift into more strategic work. Over time, you may monetize your book or mentor junior advisors.

Because you own your book of business, your equity lies in client retention and growth. That means your income escalates as you stack assets and deepen client relationships. Your long-term value is not just income today but the client base you build for tomorrow.

Real Success Stories from DFSIN Toronto West Advisors

At DFSIN Toronto West, success comes from a shared commitment to independence, mentorship, and community. Each advisor’s story reflects how collaboration and trusted support can help build thriving financial practices and lasting client relationships.

Basak Koksal

A rising star in life insurance, Basak Koksal has quickly made her mark through trust, authenticity, and client dedication. As a Life Insurance Advisor with DFSIN Toronto West, she focuses on delivering value-driven advice that helps individuals and families feel confident about their financial future. Her early achievements, including earning a 2024 Top New Advisor recognition, show how dedication and the right environment drive real results.

Luisa Hrysio

With over 20 years in the financial services industry, Luisa Hrysio stands out for her commitment to empowering families and individuals. As a financial advisor and mutual fund branch manager, she combines her experience with a personal approach to financial planning. Her long-term success demonstrates how DFSIN’s culture of mentorship and professional growth supports advisors who lead with integrity and care.

Sonia Khadwal

Sonia Khadwal is known for her ability to connect with two important communities: technology professionals and new Canadians. Her expertise in life insurance and investment planning helps clients navigate complex financial decisions with confidence. Sonia’s story highlights how DFSIN advisors bring empathy, adaptability, and purpose to every relationship.

Craig Lizun

Based in Southern Ontario, Craig Lizun has built a reputation as a trusted financial professional for young entrepreneurs and business owners. With more than a decade of experience, Craig specializes in strategic investment and insurance planning that supports both personal and business growth. His journey reflects how DFSIN fosters entrepreneurial spirit within a collaborative and supportive network.

Ian Gawel

With over 15 years of experience in life insurance and investment advisory, Ian Gawel focuses on helping individuals and families achieve long-term financial stability. His comprehensive approach to wealth management, grounded in trust and education, embodies the advisor-client relationships that define DFSIN Toronto West’s success.

Vince Vivona

With more than 25 years in the industry, Vince Vivona exemplifies consistency and expertise. Specializing in life and group insurance solutions, Vince’s extensive experience and client-first approach make him a valued mentor among peers. His success story reinforces how experience, collaboration, and DFSIN’s support system create enduring value for clients and advisors alike.

Discover Your Path with DFSIN Toronto West

Every advisor’s journey is different, yet they share one foundation: growth backed by guidance, independence, and the strength of the Desjardins brand. If you’re ready to shape your own success story, DFSIN Toronto West provides the tools, mentorship, and community to help you achieve it.

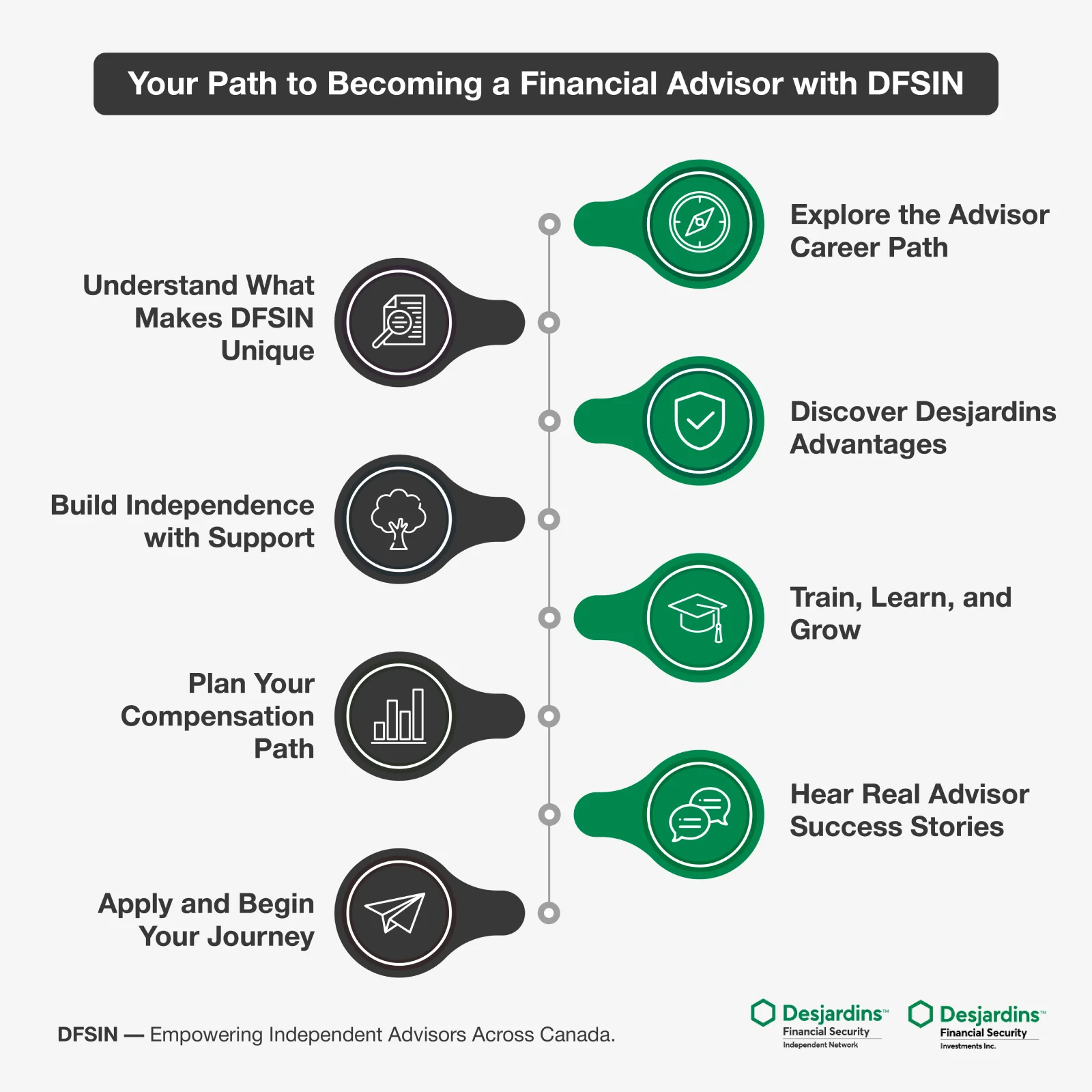

Steps to Become a Financial Advisor with DFSIN

Here is a simple, action-oriented path to get started with DFSIN:

- Licensing & Compliance Setup: You acquire the required securities, life insurance, and mutual fund licenses. You register with provincial regulators.

- Apply to Join DFSIN: Submit your advisor application through DFSIN’s partner program.

- Transition or Launch Your Practice: If you have an existing book, you transition it. If not, you launch using DFSIN’s onboarding, tech tools, client funnels, and centre support.

- Onboarding & Mentorship: You receive structured training, mentorship, and compliance orientation.

- Business Development: You roll out your marketing, lead generation, client meetings, and conversion systems.

- Growth & Scaling: You hire support, cross-sell, deepen client relationships, invest in client retention and referral systems.

This path is designed to guide you from newbie to high-performing advisor within DFSIN’s ecosystem.

How to Apply and Start Your DFSIN Toronto West Journey

Here’s how you begin your DFSIN Toronto West journey in concrete steps:

- Contact & Inquiry: Reach out to DFSIN Toronto West via their contact page or join-us portal to express interest.

- Meet & Screening: You’ll meet with DFSIN Toronto West leadership and local centre staff to review fit, background, niche strategy, and goals.

- Formal Onboarding: You’ll complete paperwork, submit licensing documents, data agreements, compliance forms, and gain access to back-office systems.

- Launch Support: You’ll receive marketing materials, client templates, tech access, mentorship programming, and centre resources.

- First Client Acquisition: With support and guidance, you begin attracting prospects, running discovery, closing, and onboarding them under your brand within DFSIN.

This timeline may vary by province, license path, prior experience, and the local centre’s readiness.

FAQ

What qualifications do I need to become a financial advisor in Canada?

You generally need to pass securities and insurance licensing exams relevant to your province (e.g., mutual funds, life insurance, financial planning). You may need registration with provincial securities regulators. Many advisors also acquire designations like CFP, CLU, or advanced planning credentials to earn client trust.

Can I join DFSIN Toronto West as a new financial advisor with no prior experience?

Yes. DFSIN Toronto West supports emerging advisors with training, mentorship, field help, and onboarding resources. The network is structured to help you build from a foundation, even without an existing book of business.

How does DFSIN Toronto West differ from other financial advisor networks in Canada?

DFSIN Toronto West offers true independence; you own your book, but combine it with the infrastructure, tools, brand strength, and compliance support of a national network. You get both autonomy and backing, which many competing networks either limit or don’t offer fully.

Building Success by Becoming a Financial Advisor in Canada

Now that you see each element, the “why,” the differentiation, the backing, the training, the compensation, the stories, the path, you hold a blueprint. You can structure your practice with clarity and confidence. You can align your brand, design your client experience, manage compliance, scale, and measure ROI.

If you are ready to press forward, take this moment. Begin your journey, commit to growth, leverage the structure of DFSIN, lean into mentorship, and build with intention. Your career as an advisor isn’t just a role: it can be a thriving enterprise you own.

If you’d like help preparing your application, refining your niche pitch, or building your lead funnel before you join, just say the word.

Table of Content

- Why Become a Financial Advisor in Canada

- What Makes DFSIN Toronto West Different from Other Financial Networks

- The Advantages of Partnering with Desjardins

- How DFSIN Toronto West Supports Your Independence and Growth

- Training, Mentorship, and Continuing Education Opportunities

- Compensation and Career Path as a DFSIN Toronto West Advisor

- Real Success Stories from DFSIN Toronto West Advisors

- Steps to Become a Financial Advisor with DFSIN

- How to Apply and Start Your DFSIN Toronto West Journey

- FAQ

- Building Success by Becoming a Financial Advisor in Canada