What Influences the Cost of Critical Illness Insurance in Canada?

The cost of critical illness insurance in Canada depends on factors like your age, health, coverage amount, and the type of plan you choose. If you’re worried about managing the cost or handling unexpected medical expenses, Desjardins critical illness insurance offers a lump sum payment upon diagnosis of a covered illness. This payout gives you flexibility, you can use it for out-of-pocket costs, upgraded care, or anything that helps reduce financial stress during recovery. The choice is yours. Of course, the exact monthly premium will vary based on your personal circumstances.

Key Takeaways:

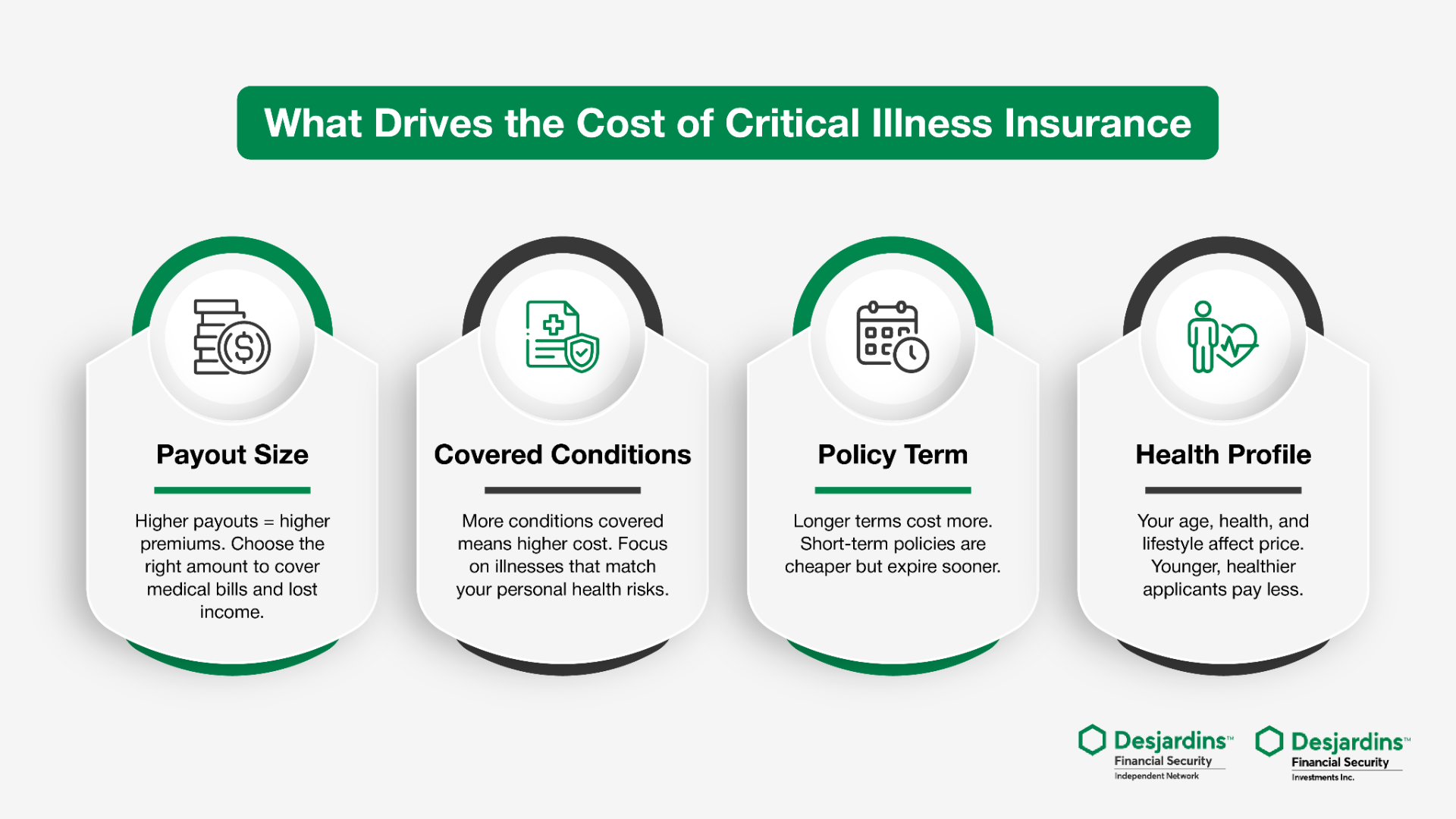

- The cost of critical illness insurance in Canada depends on four main factors: payout size, covered conditions, policy term, and your personal health profile.

- Choosing between guaranteed and renewable premiums plays a major role in your long-term costs; guaranteed premiums offer price stability, while renewable premiums start lower but rise over time.

- Working with an advisor can help you align your coverage with your budget and financial goals, so you can protect yourself without overpaying.

Four Factors That Determine the Cost of Your Critical Illness Insurance

The cost of critical illness insurance in Canada is shaped by four key factors: the size of the payout, the conditions you choose to cover, the term of the policy, and your personal health profile. Each of these has a direct impact on what you’ll pay in monthly premiums. Let’s break them down so you can see where your costs come from.

1. Payout Size and Its Financial Impact

This is the biggest driver of cost. The higher the payout you choose, the more your premiums will be, because the insurer is promising to provide more money if you’re diagnosed.

- Common payout options: $10,000 to $100,000 or more.

- Why it matters: A larger payout gives you more financial breathing room. You can use the money to cover medical bills, home care, or simply replace lost income while you recover.

- Cost impact: The bigger the payout, the higher your monthly cost.

2. Medical Conditions Covered Under the Policy

You can fine-tune your plan by deciding which illnesses are included. This flexibility lets you balance between protection and affordability.

- Basic plans: Might cover a handful of major illnesses, such as cancer, heart attack, and stroke.

- Comprehensive plans: Often cover 25 or more conditions, including things like multiple sclerosis, organ transplants, and severe burns.

- Custom coverage: Some people skip coverage for conditions that don’t run in their family, for example, excluding heart disease if that’s not a concern, keeping costs lower.

3. Policy Term and Duration Options

How long your coverage lasts plays a big role in determining cost. Like life insurance, longer terms mean higher premiums.

- Short-term policies: Typically 10, 20, or 30 years; often used to cover working years when financial responsibilities are highest.

- Lifelong policies: Provide permanent coverage but at a higher price.

- Cost impact: The longer the term, the more you’ll pay because the risk to the insurer increases over time.

4. Your Personal Health Profile

Your age, health, and lifestyle all factor into the price. Insurers assess your level of risk when calculating premiums.

- Age: The younger you are when you apply, the lower your premiums are likely to be.

- Health history: Pre-existing conditions or a history of serious illness can increase costs.

- Lifestyle: Smoking or other high-risk behaviours usually result in higher premiums.

Choosing Between Guaranteed or Renewable Premiums

One of the most important decisions you’ll make when buying critical illness insurance is how your premiums will work over time. This choice directly affects both what you pay now and how your costs will change in the future. You’ll typically choose between two options: renewable premiums, which can increase as you age, or guaranteed premiums, which stay fixed for the life of your policy. Understanding these two options will help you choose the one that best fits your budget, goals, and risk tolerance.

What Are Renewable Premiums?

Renewable premiums are designed to give you a lower cost at the start of your policy. They’re often attractive to people who want affordable coverage right away but plan to adjust or upgrade their insurance later.

- How renewable premiums work: Your premiums are reviewed and adjusted at set renewal periods, often every 10, 20, or 30 years. Each time your policy renews, the insurer recalculates your premium based on your age at that time.

- Why people choose them: If you’re just starting out financially, or if you want to keep short-term costs low while building your savings or paying off debt, renewable premiums can seem like a smart option.

What to watch for: While renewable premiums are initially cheaper, they almost always increase sharply at renewal. As you get older, the cost can become much higher than guaranteed premiums, especially if your health changes or you want to extend coverage beyond the original term.

What Are Guaranteed Premiums?

Guaranteed premiums give you cost certainty from day one. With this option, you pay a fixed amount every month for the entire term or lifetime of your policy, no increases, no surprises.

- How guaranteed premiums work: Once you choose your coverage and lock in your premium, it stays the same for the duration of the policy, regardless of your age or changes to your health.

- Why people choose them: Guaranteed premiums suit people who want predictability and peace of mind. You can plan your budget knowing exactly what your insurance will cost, year after year.

Long-term advantage: Although guaranteed premiums often start out higher than renewable premiums, they’re typically the better value over time. Because your rate never increases, you avoid the sharp cost jumps that come with renewable plans as you age.

Key Factors That Affect Your Premium Choice

Deciding between renewable and guaranteed premiums isn’t just about cost, it’s about what works for your life today and tomorrow. Here’s what to think about before you choose:

- Age: Younger applicants benefit the most from locking in guaranteed premiums because they’ll secure a low rate for decades.

- Budget flexibility: Renewable premiums offer lower starting costs, which can help if you have other financial priorities right now. Just remember, future increases can strain your budget later.

- Health considerations: Guaranteed premiums shield you from cost hikes if your health changes. With renewable premiums, those changes could make future renewals unaffordable.

- How long you want coverage: If you only need insurance for a set period, say, until your kids are grown or your mortgage is paid off, renewable premiums might work. If you want lifelong protection, guaranteed premiums usually make more financial sense.

Why Work With an Advisor?

Choosing between renewable and guaranteed premiums isn’t always straightforward. There are trade-offs, and the right choice depends on your unique situation.

- Desjardins offers both options: Their critical illness insurance pricing takes into account your age, sex, smoking status, and health profile. The right premium structure can help you manage costs while ensuring the coverage you need.

- An advisor can help you decide: A licensed insurance advisor can help you compare premium types, model future costs, and align your choice with your long-term financial goals.

No matter which premium option you choose, critical illness insurance provides a vital safety net. If you’re diagnosed with a covered condition like stroke, cancer, or heart attack, you’ll get a tax-free lump sum to help cover medical bills, replace lost income, or support your recovery in whatever way you need.

FAQs

What Is The Most Important Factor Influencing Critical Illness Insurance Premiums?

The payout size you choose is usually the single biggest cost driver. The larger the lump sum you want paid out if you’re diagnosed with a covered illness, the higher your monthly premium will be. For example, a policy offering a $100,000 payout will cost noticeably more than one offering $25,000 because the insurer takes on more financial risk. The key is to choose a payout that gives you enough protection to cover medical bills, home care, or lost income without stretching your budget beyond what’s manageable.

Can I Lower My Critical Illness Insurance Cost Without Losing Essential Coverage?

Yes, and it starts with tailoring your policy to fit your actual needs. You can reduce costs by:

- Covering conditions that matter most to your situation. For example, if cancer runs in your family but there’s no history of heart disease, you could adjust your coverage accordingly.

- Choosing a shorter policy term. Shorter terms often cost less per month compared to lifelong coverage.

- Selecting the right premium structure. Renewable premiums start cheaper, though they rise over time.

Working with an advisor can help you weigh these options carefully so you keep meaningful protection while avoiding unnecessary costs.

Are Guaranteed Premiums Always The Best Choice?

Not always. It depends on your financial goals and how long you want coverage. Guaranteed premiums are ideal if you want cost certainty over the long term. They lock in your rate for the entire policy duration, so your premiums never increase no matter your age or health changes.

On the other hand, renewable premiums might suit you if you’re focused on keeping upfront costs low. They start cheaper, but the price rises each time the policy renews. This can work if you expect your income to grow or plan to review your insurance later. The right choice comes down to how much risk you’re willing to take on future cost increases versus how much stability you want today.

Finding the Right Coverage for Your Situation

Desjardins critical illness insurance gives you a reliable safety net, providing a tax-free lump sum if you’re diagnosed with a covered condition like a stroke, cancer, or heart attack. The cost of your policy depends on personal factors such as your age, sex, smoking status, and overall health. That’s why it’s smart to take time now to review your options carefully. The right plan should match both your budget today and your long-term savings goals.