The Importance of a Critical Illness Plan

Originally published: December 1, 2020 | Updated: August 24, 2025

A critical illness plan gives you financial protection when your health is at its most vulnerable. With cancer rates continuing to rise across Canada, this type of coverage has become more relevant than ever. A serious diagnosis doesn’t just affect your physical health; it can also create overwhelming pressure on your finances and emotional well-being. From lost income to out-of-pocket medical costs, the financial ripple effect can quickly escalate.

In this article, we’ll cover why this type of insurance is becoming more common, what a critical illness plan covers, and how you can protect yourself and your family from the unexpected.

Key Takeaways

- 1 in 2 Canadians will experience cancer in their lifetime, with specific risks varying between men and women.

- The financial impact of critical illness goes beyond treatment costs, often affecting family income and long-term financial stability.

- A critical illness plan provides a tax-free lump sum payment to help you manage life during recovery.

Cancer Statistics in Canada

Cancer continues to be one of the most common and disruptive illnesses affecting Canadians. It’s projected that 1 in 2 Canadians will develop cancer in their lifetime. That equates to a 49% chance for males and a 45% chance for females. [1]

More detailed projections include:

- 1 in 8 females are expected to develop breast cancer

- 1 in 14 females will be diagnosed with lung cancer

- 1 in 16 females will face colorectal cancer

- 1 in 7 males will develop prostate cancer

- 1 in 11 males are at risk for lung cancer

- 1 in 13 males are likely to be diagnosed with colorectal cancer [2]

These numbers reinforce the importance of evaluating critical illness insurance plans early.

The Financial Toll of Being Diagnosed with a Critical Illness

The emotional shock of a diagnosis is heavy enough. Still, financial stress often follows just as quickly. Questions like “How long will I be off work?” or “Can I afford the treatment I need?” become real concerns within days. Your ability to earn income might be paused, while expenses often increase.

For many families, the direct costs of treatment (prescriptions, medical equipment, travel) are just the start. Indirect costs, such as lost wages or time off for caregivers, add up. Those without substantial savings often face difficult choices, sometimes dipping into retirement accounts or going into debt.

The Financial Impact on Families: Are You Prepared?

A national study from 2013 revealed a hard truth: many households aren’t financially prepared for a serious diagnosis. Here’s how people responded to the possibility of a critical illness in the family:

- 28% would struggle to meet daily expenses immediately

- 39% would face financial difficulty within months

- Only 33% felt confident they could maintain their lifestyle long-term

These numbers highlight a widespread gap in financial preparedness. That’s where a critical illness plan steps in to reduce uncertainty when it matters most. [3]

The Importance of a Critical Illness Insurance Plan

Whether you’re focused on retirement, education savings, or managing debt, a critical illness insurance plan is a smart layer of protection. It complements your financial strategy by helping you recover without sacrificing your long-term goals.

If you’re unsure about your needs, start by understanding the importance of critical illness insurance. This kind of planning often makes the difference between financial survival and hardship.

How Critical Illness Coverage Can Protect You

A critical illness plan provides a one-time, tax-free payout if you’re diagnosed with a covered condition like cancer, heart attack, or stroke. You choose how to use the funds, paying off debt, covering treatment costs, funding private care, or maintaining your lifestyle while you recover.

This flexibility is what makes critical illness coverage distinct from other insurance types. It doesn’t replace your salary. It gives you control over your finances when you’re temporarily unable to earn. You’re not limited to covering just medical bills; your benefit could support home modifications, child care, or even alternative therapies.

Read more on critical illness insurance options from DFSIN.

What Does a Critical Illness Plan Cover?

Coverage varies by provider, but most critical illness insurance plans cover a core list of conditions that represent some of the most common and financially disruptive health events. These conditions are selected based on their prevalence, cost of care, and long-term impact on a person’s ability to work or maintain a stable household.

Insurers typically use well-defined medical criteria to determine eligibility for payouts, ensuring that the policy provides meaningful support when it’s needed most. These often include:

- Cancer (life-threatening forms)

- Heart attack

- Stroke

- Organ transplant

- Kidney failure

- Multiple sclerosis

- Parkinson’s disease

Some providers also offer partial payouts for early-stage diagnoses or non-life-threatening conditions. It’s important to review the terms and definitions of each condition.

Are Critical Illness Plans Worth It?

Are critical illness plans worth it? Absolutely, especially if you have financial obligations that can’t be paused during a health crisis. These plans are designed to provide a safety net when you’re at your most vulnerable. A lump-sum payment from a critical illness plan can give you the freedom to make healthcare decisions based on need, not finances, and protect your long-term goals.

The average Canadian household carries more than $20,000 in consumer debt. When illness strikes, expenses can spike while income drops, putting you at risk of falling behind on bills, depleting savings, or accumulating more debt. A critical illness plan helps offset this pressure by covering not just medical costs but also everyday expenses like rent, utilities, groceries, or child care.

Beyond numbers, the true value lies in peace of mind. Knowing you have a plan in place allows you and your family to focus on recovery, not financial survival.

How to Compare Critical Illness Plans

When you start to compare critical illness plans, it’s not just about finding the lowest premium. You’re making a decision that could influence how well you recover, financially and personally, after a diagnosis. To make an informed choice, look at the plan from multiple angles:

- Covered Conditions and Exclusions: Review not only what’s included, but also what’s not. Some policies are limited to the three major conditions, while others cover more than 25 illnesses.

- Waiting Period Before Benefits Apply: Most plans have a waiting period after diagnosis before you can access the benefit. Understanding this can affect how you plan for short-term needs.

- Policy Renewability and Term Length: Know whether your coverage renews automatically or expires at a certain age. Long-term coverage is key for peace of mind.

- Premium Stability: Ask whether your premium will stay the same over time or increase as you age. Stable premiums can make budgeting easier.

- Return of Premium Option: Some plans offer a feature where, if you never make a claim, you get a portion or all of your premiums back. This can make the policy feel more like a financial asset.

Comparing policies may seem complex, but it’s worth the effort. A licensed DFSIN advisor can break it all down and help match a plan to your lifestyle, career stage, and financial goals.

Building a Critical Illness Recovery Plan

A critical illness recovery plan goes beyond financial support. It includes lifestyle adjustments, treatment schedules, mental health strategies, and support networks. Your insurance policy is one part of that structure, helping ensure stability while you navigate the rest.

Other components may include:

- Access to counselling or therapy

- Flexible work accommodations

- Childcare and household support

- Guidance from care coordinators or social workers

Having a strong recovery framework makes it easier to focus on healing.

Incorporating a critical illness plan into your recovery strategy provides more than just financial relief, it adds predictability during uncertain times. With coverage in place, you’re free to prioritize medical decisions based on quality and comfort, not cost. It can also reduce pressure on loved ones, enabling them to support you without the added stress of juggling household or financial responsibilities.

When Should You Get a Critical Illness Plan?

Timing matters when it comes to purchasing a critical illness plan, and acting early has its advantages. Premiums are generally lower when you’re young and healthy, and you’re more likely to qualify without restrictions or exclusions. Many people wait until a major life event forces them to reconsider their coverage, but waiting can cost you both financially and medically.

Getting covered early creates a stable foundation for future planning. You won’t have to worry about rushing to find coverage after a diagnosis in the family or a change in health status. It also offers peace of mind as your responsibilities grow.

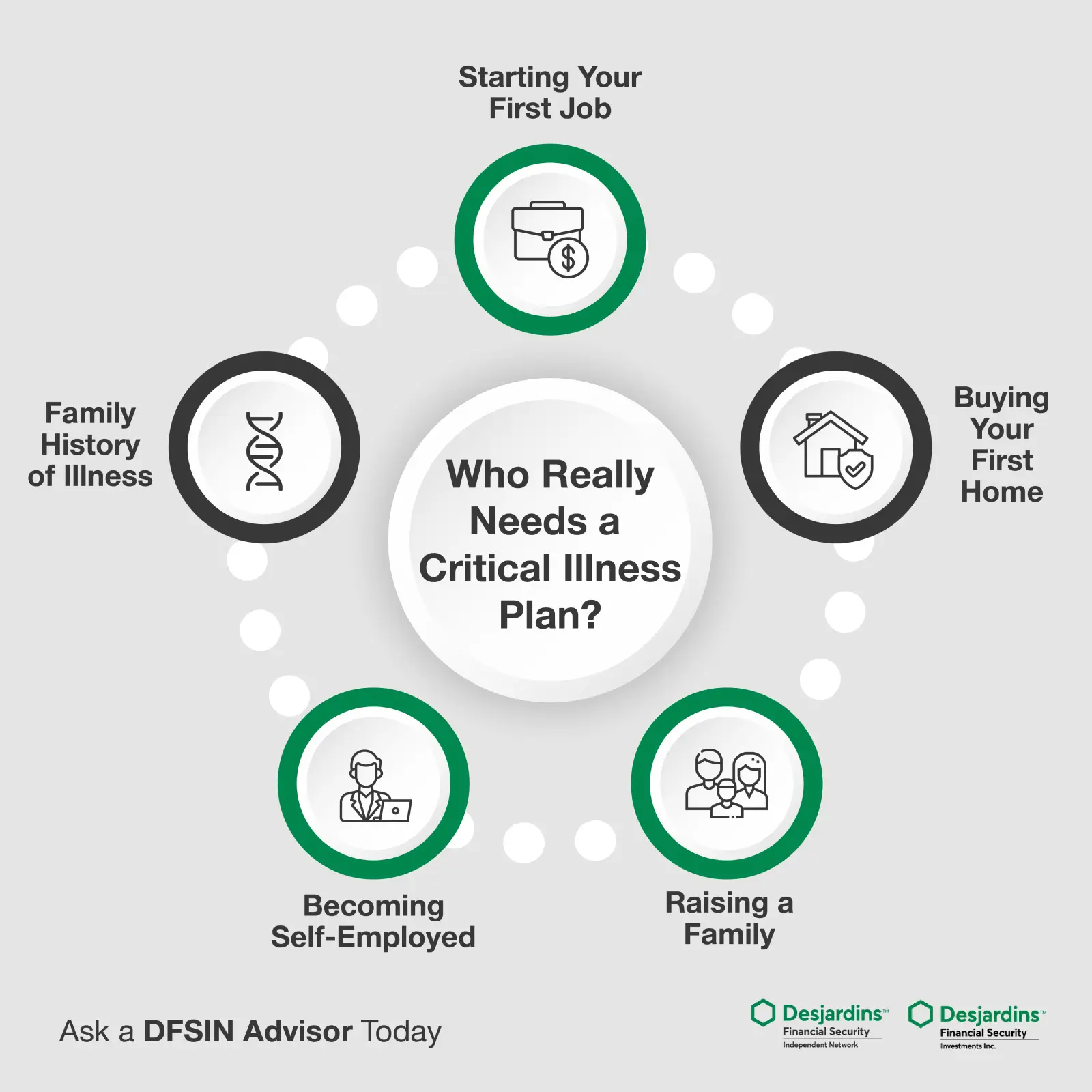

Consider applying for a critical illness plan:

- As part of your first job’s benefits review

- After buying your first home

- When starting a family

- Following a medical diagnosis in the family

- Before planning a major life change, such as self-employment or relocation

By locking in lower premiums early, you’re making a practical investment in your future stability. The earlier you take action, the more control you’ll have over your options when it matters most.

Understanding the Importance of a Critical Illness Plan

A critical illness plan is more than a financial product; it’s a practical step toward protecting your future. Throughout this article, we explored how common serious illnesses are, how they can quickly disrupt your finances, and how this type of insurance can offer real support when you need it most. From understanding what a plan covers to evaluating when to get one, the value is clear. A well-structured critical illness plan can help you recover without financial setbacks and give your family the breathing room they deserve.

[3] 2013 Canadian Life Ownership Study

Table of Content